"The phrase "It's all gone Pete Tong", where the name is used as rhyming slang for "wrong", was reputedly first coined by Paul Oakenfold in late 1987 in an article about Acid House called 'Bermondsey Goes Balearic' for Terry Farley and Pete Heller's 'Boys Own' Fanzine."

Bloomberg chart of the day:

Gold and the US Debt ceiling.

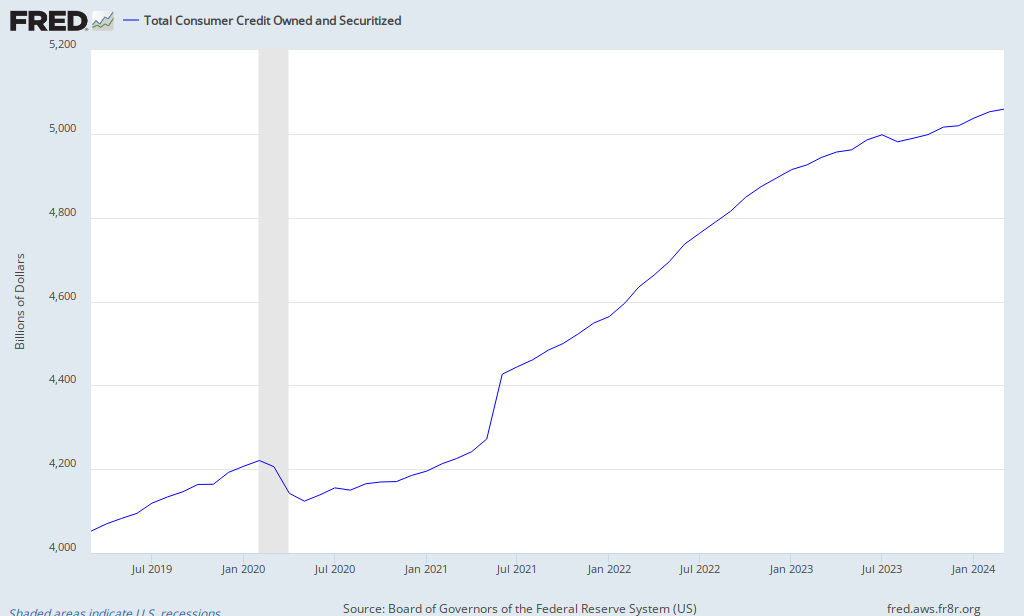

Meanwhile in the US, how do consumers face rising costs, lower wages and so forth? The answer is...credit cards!

Consumers in U.S. Relying on Credit as Inflation Erodes Incomes - Bloomberg

"The dollar volume of purchases charged grew 10.7 percent in June from a year ago, while the number of transactions rose 6.8 percent, according to First Data Corp.’s SpendTrend report issued this month. The difference probably represents the increasing cost of gasoline, said Silvio Tavares, senior vice president at First Data, the largest credit card processor.

“Consumers, particularly in the lower-income end, are being forced to use their credit cards for everyday spending like gas and food,” said Tavares, who’s based in Atlanta. “That’s because there’s been no other positive catalyst, like an increase in wages, to offset higher prices. It’s a cash-flow problem.”

Rising costs of food and gasoline are leaving Americans less money to spend discretionary items, slowing the pace of the recovery, Tavares said. Household spending accounts for about 70 percent of the world’s largest economy."

Also in the article:

"The volume of gasoline purchases placed on credit cards jumped 39 percent last month from a year earlier, compared with a 21 percent increase in June 2010, he said. Food shopping increased 5 percent after falling 7 percent last year."

Here is what's going on:

Bloomberg chart of the day:

Gold and the US Debt ceiling.

Meanwhile in the US, how do consumers face rising costs, lower wages and so forth? The answer is...credit cards!

Consumers in U.S. Relying on Credit as Inflation Erodes Incomes - Bloomberg

"The dollar volume of purchases charged grew 10.7 percent in June from a year ago, while the number of transactions rose 6.8 percent, according to First Data Corp.’s SpendTrend report issued this month. The difference probably represents the increasing cost of gasoline, said Silvio Tavares, senior vice president at First Data, the largest credit card processor.

“Consumers, particularly in the lower-income end, are being forced to use their credit cards for everyday spending like gas and food,” said Tavares, who’s based in Atlanta. “That’s because there’s been no other positive catalyst, like an increase in wages, to offset higher prices. It’s a cash-flow problem.”

Rising costs of food and gasoline are leaving Americans less money to spend discretionary items, slowing the pace of the recovery, Tavares said. Household spending accounts for about 70 percent of the world’s largest economy."

Also in the article:

"The volume of gasoline purchases placed on credit cards jumped 39 percent last month from a year earlier, compared with a 21 percent increase in June 2010, he said. Food shopping increased 5 percent after falling 7 percent last year."

Here is what's going on:

Total Consumer Credit Outstanding, from deleveraging to releveraging...

Even if the average price of a gallon has dropped 7.6% from the 4th of May, which was a three year high, even if tapping the strategic oil reserves, has helped in the short term to alleviate the pressure on prices, it is not enough to address the cash flow issues faced by Joe Six-Pack aka the US consumer:

The struggle to eat - The Economist - 14th of July.

"As Congress wrangles over spending cuts, surging numbers of Americans are relying on the government just to put food on the table."

"Participation has soared since the recession began (see chart). By April it had reached almost 45m, or one in seven Americans. The cost, naturally, has soared too, from $35 billion in 2008 to $65 billion last year. And the Department of Agriculture, which administers the scheme, reckons only two-thirds of those who are eligible have signed up."

Who is benefiting form this much needed form of aid?

"Only those with incomes of 130% of the poverty level or less are eligible for them. The amount each person receives depends on their income, assets and family size, but the average benefit is $133 a month and the maximum, for an individual with no income at all, is $200."

"About half of them are children, and another 8% are elderly. Only 14% of food-stamp households have incomes above the poverty line; 41% have incomes of half that level or less, and 18% have no income at all. The average participating family has only $101 in savings or valuables."

And the article to conclude:

"When Moody’s Analytics assessed different forms of stimulus, it found that food stamps were the most effective, increasing economic activity by $1.73 for every dollar spent. Unemployment insurance came in second, at $1.62, whereas most tax cuts yielded a dollar or less."

And if you think the US credit card binge is only a US problem, it isn't. It is happening in the UK as well.

A quarter of Britons can't survive the month without credit cards - Jessica Bown

"A quarter of struggling British workers regularly rely on their credit cards when their cash runs out, with the average person pulling out the plastic just 21 days after being paid each month, according to a new survey from comparison website Moneysupermarket."

Dear Ben Bernanke, I know you and your friends are thinking about QE3 given poor economic data and high unemployment, before you go ahead, think about the impact it would have on Joe Six-Pack...

Because, if you think a surge in credit-card usage is a sign of surging consumer confidence, think again...

No comments:

Post a Comment