"US Residents are taxed on worldwide income and allowed a credit for foreign taxes."

We all know why Greece is in trouble, due to its kleptocracy and tax avoidance, which, we all know by now, is a national sport.

The problem with Greece are of fiscal nature, given 30 billion euros escape the fiscal net on a yearly basis which represents a staggering 12% of GDP.

As I posted previously in "Markets - Liquidity? The IV Greek Credit Therapy":

"One thing Greece must address is tax cheats who represents 30 billion euros, or 12 per cent of GDP, every year. Another American solution to European woes would be, for Greece, to tax its citizens on their worldwide income, similar to the US. It would be a very efficient way to stabilise its ailing banking system and deposit outflows given one third of its funds withdrawn have gone abroad for fear of a crackdown on tax evasion. By imposing Greek citizen on their worlwide income like US citizens, and with the help of Luxembourg authorities, Cyprus, Switzerland and the United Kingdom, the outflow could be stemmed and vital tax receipts could rapidly help close the gap on the very acute budget deficit, but that's another story..."

The U.S. federal and most state income tax systems tax the worldwide income of resident so comparing the US to Greece, regardless of the currency issuer and non currency issuer debate, is stupid.

It doesn't mean the US doesn't need to address its current fiscal trajectory, that's another matter altogether. But, comparing these two countries, one being the United States with an efficient tax system run by the I.R.S. and Greece, where its tax collection system is in shamble, is proper nonsense.

Efficient system you say?

Here are few facts relating to the IRS:

"From the 1950s through the 1970s, the IRS began using cutting-edge technology such as microfilm to keep and organize records."

After microfilm, the 1960s onward saw massive computerization efforts.

In 1995, the IRS began to use the public Internet for electronic filing. Since the introduction of e-filing, self-paced online tax services have flourished, augmenting and sometimes replacing tax accountants to prepare returns.

In 2003, the IRS struck a deal with tax software vendors:

The IRS would not develop online filing software. In return, software vendors would provide free e-filing to most Americans.

In 2009, 70% of filers qualified for free electronic filing of federal returns.

In 2010, more than 66% (98 million) of tax returns are expected to be filed electronically."

Try to find a similar system in Greece...

So yes, if Greece was the US, in relation to its current worldwide tax system and more efficient collection process, it would not need countless bailout plans and we could all sleep better at night, at least in Europe...

Wednesday, 31 August 2011

Markets update - Credit Ripcord? Update on markets move and review of the CDS market and more.

Today brought some welcome respite in the credit space, which was also the case in the equity space, with most indices in positive territory.

The tightening of some Itraxx credit indices has been important but, although I do not want to sound like a perma bear, it is too early to say if this rally will be short lived or not given: the economic data being on the weak side and the ongoing European sovereign debt crisis not yet being resolved.

The iTraxx Crossover Index (40 companies mostly high-yield credit ratings) dropped by around 23 basis points to 658 bps in the morning, as a follow up to the minutes of the FOMC meeting suggesting markets might get an addtional of QE down their veins.

In relation to corporate credit, the Itraxx Main Europe 5 year index (investment grade corporate debt) also retreated to around 155 bps.

Truth is corporate debt is still perceived as safer than financial debt as per the below graph displaying Itraxx Financial 5 year Index versus Itraxx Main Europe 5 year:

The rally in credit was pretty much all accross the board, even in the sovereign space where Portugal 5 year sovereign CDS tightened by around 36 bps and Ireland was 21 bps lower to around 783 bps:

The Itraxx SOVx representing 15 countries of Western Europe was as well tighter on the day by around 11 bps to 289 bps on the 5 year point:

The interesting point is that the SOVx Western Europe index on the 5 year is still wider than its Central Europe and Middle East counterpart, namely SOVx CE as per the above graph.

In conjunction with the Fed's minute for the FOMC meeting, we had some noise from Germany relating to the EFSF, as the German cabinet ratified an expansion plan of the facility.

While the rally was significant, we are still on elevated levels for Financial Senior Itraxx indices and Subordinate:

Itraxx Financial Senior 5 year index:

and Itraxx Financial Sub 5 year index:

At the same time liquidity as indicated partly by OIS Libor spread, has not improved significantly yet:

So yes, there was a feeling of a "credit ripcord effect" today, in relation to our previous post relating to terminal velocity and parachuting, looks like there is a welcome pause in the unabating widening process with have been witnessing throughout the month of August.

In relation to the issue surrounding Greek debt, I found some interesting data in the latest issue from Creditflux magazine:

Greek Sovereign write-downs up to 25th of August - Source Creditflux

According to Creditflux, banks and insurance companies have written down their Greek goverment debt holdings in recent weeks by 5.3 billion euros, representing a 21% haircut that will result to their "voluntary" participation to the debt exchange proposed on the 21st of July. What is interesting from the information extracted from the September 2011 Creditflux issue is that smaller German player Dekabank has been much more agressive in the write-down process, a 50 million euros bond in its held-to-maturity book (banking book) was cut to its market value of 47 cents to the dollar.

In relation to the review of current CDS market, here are some more information on the players:

Leading CDS counterparties - Source Creditflux - As of 1st of July 2011:

The most actively traded CDS remains Credit Indices. In Europe, Itraxx Main Europe and Itraxx Crossover are actively traded.

Top CDS counterparties according to Creditflux are:

Single name trade size is in the 5 million USD notional amount to 20 million, 5 year being the most liquid part of the curve and most quoted. Indices such as Itraxx Main Europe can trade in clips of 100 million euros in notional amount.

Creditflux Top index families:

But given current volatility and depending on the level of spread of a specific single name CDS, sometimes 5 million USD trade can move the market.

In recent weeks the most actively traded names have been in the financial space, given they are the most frequent issuers in the market and the debt they issue may vary in complexity from Tier 1 subordinated debt, with callable features and step-up features to plain vanilla senior fixed bonds.

Source Creditflux:

Source Creditflux - Corporate Top sectors traded and top names:

Although the market in Europe has been virtually shut down in the corporate space in August, last couple of days have seen some banks tapping the market via covered bonds only. In Europe, risk appetite so far hasn't yet come back and we have not seen in Europe some new issues from the corporate space.

So we know who are the dealers, but who are the active clients in the CDS space?

While real money accounts are becoming more active, major buyers and sellers remain so far hedge funds and trading desks. The new players which have developed in recent years are CVA desks (Credit Valuation Adjustment).

What are CVA desks?

CVA desks within banks are managing counterparty credit risk using CDS.

As per Creditflux:

"For a given portfolio of trades facing the same investor or institution, the credit valuation adjustment (CVA) aims to capture the expected loss associated with the counterparty defaulting in a situation in which the position, netted for any collateral agreement, has a positive mark-to-market for the dealer."

In relation to volumes trade and net exposure relating to the CDS market, information is available using the following link to the DTCC website:

DTCC Further Expands Public Release Of CDS Data

That's all folks for now!

To be continued shortly!

Tuesday, 30 August 2011

Markets update - "My slim fast Greek wedding..."

Quick post on the Greek merger as a follow up:

The ink wasn't even dry when I posted last Friday on the strong possibility of consolidation in the Greek Financial sector (Markets - Liquidity? The IV Greek Credit Therapy)that on Saturday there were some rumours about number 2 and number 3 Greek banks in a shotgun wedding, namely Eurobank and Alpha Bank, which was announced on Monday. Eurobank received 3 billion euros in emergency funding, courtesy of ELA (see previous post), when Piraeus receive 2 billion euros (number 4, next candidate in the consolidation process...).

Consequences, the rally monkey was unleashed and both shares rised quickly to the limit up of 30% and Athen's ASE index to rise the most since 1990 on Monday.

Much ado about nothing given the strong correlation between Greece and its banks. The fate of Greek Banks is sealed with the fate of their country, as I previously posted, given Greece is a major creditor to its banks.

In the process of the merger both banks will take a 1.2 billion euros haircut on their holdings of sovereign bonds (only a 21% haircut, with two year Greek notes trading at 46% yield...). I call this the "slim fast" Greek wedding.

Eurobank was one of the eight banks that failed the EBA "stress" test of the 15th of July and there wasn't much stress in these tests as we all know buy now (for example Tier one threshold was 5% this year, versus 6% in 2010...).

So what do you get when you merge two weak banks together? Easy, a larger weaker bank.

And the chief executive of Eurobank looking to raise 1.2 billion euros through a right issue next January as part of a 3.9 billion euros capital strengthening programme, so that the new pro forma core tier one would be around 14%. Good luck in raising this amount.

Alpha Bank reported a first half-net profit of 14 million euros before impairment losses of 532 million euros and Eurobank reported 76 million euros before taking a 660 million euros loss on their Greek bonds...

So loans are turning sour, we learn from my previous post, with rising NPL (Nonperforming loans) and Deposits are falling, thanks to Greek tax evaders shifting their assets to Cyprus, Switzerland, United Kingdom and Luxembourg.

And the icing on the cake, Euro zone is considering providing donor members including Finland with collateral in the form of Greek banking shares to secure the next aid package decided on the 21st of July according to Germany's Handelsblatt. Of the 109 billion expected from the plan, 20 billion euros are earmarked for Greek banks.

With one year government bills yielding 60%, we can only imply that the default will come sooner than expected. Was that what Christine Lagarde at the IMF was implying when she urged for urgent recapitalization of European banks?

So what is going to be the recovery rate on Greek debt? 50%?

Friday, 26 August 2011

Markets - Liquidity? The IV Greek Credit Therapy

"Intravenous therapy or IV therapy is the giving of substances directly into a vein."

This week analogy directly relates to the news that Greece has been forced to activate emergency funding, because of collateral issues that is acceptable to the ECB.

Greece forced to tap emergency funding - Louise Armitstead - The Telegraph

"In a move described as the "last stand for Greek banks", the embattled country's central bank activated Emergency Liquidity Assistance (ELA) for the first time on Wednesday night."

ELA:

"The ELA was designed under European rules to allow national central banks to provide liquidity for their own lenders when they run out of collateral of a quality that can be used to trade with the ECB. It is an obscure tool that is supposed to be temporary and one of the last resorts for indebted banks. So far it has only be used in Ireland.

By accepting a lower level of collateral the debt in the ELA is, in theory, supposed to be the responsibility of Greece. However, since the Greek state is surviving on eurozone bailouts and Greek banks are reliant on ECB funding, in practice the loans are backed by the eurozone. The terms of lending and other details are not disclosed publicly."

Mr Raoul Ruparel of Open Europe said according to the article: "Though the ELA is meant to be a temporary emergency solution, we know from Ireland, where the programme has been running for almost a year, that once banks get hooked on ELA they rarely get off it."

Hence the analogy to IV Therapy for "zombie banks".

What is a zombie bank:

"A zombie bank is a financial institution that has an economic net worth less than zero but continues to operate because its ability to repay its debts is shored up by implicit or explicit government credit support. The term was first used by Edward Kane in 1987 to explain the dangers of tolerating a large number of insolvent savings and loan associations and applied to the emerging Japanese crisis in 1993. Zombie institutions face runs by uninsured depositors and margin calls from counterparties in derivatives transactions." - Wikipedia

In my post "Zombieland 2...The Sequel...", I described it further:

"Zombie banks often have a large amount of nonperforming assets on their balance sheets which make future earnings very unpredictable."

In essence, Greek banks are suffering the same fate as their Irish counteparts, namely becoming "Zombie banks" in the process.

Deutsche Bank on the 24th of August, published an interesting paper: "Greek and Cypriot Banks - Estimated capital shortfall."

Between the 29th and the 30th of August, we will get Quarter results for Greek banks, so watch closely the results.

What I have learned from the report so far:

"Operating profits are set to decline for as long as Greece remains in recession and global activity slows down, affecting inter alia the course of interest rates (ECB hikes)."

No surprise there given the economic outlook for Greece.

We know for a fact that following the EU summit of July 21st that the need of raising capital has been communicated by the Greek governement.

Deutsche Bank have "increased" their "impairments estimates" due to higher NPLs (Nonperforming loans). On the 22nd of August the Greek Finance minister in Bloomberg Finance stated that the recession in Greece could exceed 4.5% and stand between 4.5% and 5.3%, which is 100-200 bps worse than the latest EC forecast:

And Deutsche Bank to add:

"Greek banks continue to face the same challenges. Deposits outflows in combination with the reduction in value of collaterals placed with the ECB continue to stretch their liquidity. ECB funding spiked in May and June to E103bn (collaterals at 148bn) from E87bn in April. If banks cannot use the new E30bn state guarantee liquidity tranche, then any new liquidity needs will have to be met by the central bank's ELA facility."

There you go, it is ELA time, as indicated at the start of the post. The IV Credit line is now well in place for Greek "zombie banks".

Previously, I wrote the following, whereas in Ireland, banks sunk the government finances and the country, the Greek profligacy and their banks being overloaded with Greek government bonds sunk their financial system.

So, how are Greek banks supposed to grow their profits when lending growth is falling? They can't:

And what is happening to Greek deposits in Greek banks? They are melting away:

Greek Banks' Liquidity Is Suffering As Nervous Clients Withdraw Savings - WSJ - Philip Pangalos

"The consequence for many Greek banks is a growing shortage of liquidity that is increasing their reliance on emergency funding from the European Central Bank and forcing them to further cut lending to businesses. That, in turn, is deepening Greece's recession, making it harder for the government to narrow its gaping budget deficit."

We already know from the European Banking Association Stress tests from July 15th, that two Greek Banks failed the test: ATE Bank and Eurobank EFG.

Additional points from the Deutsche Bank report in comparison to Ireland:

"Loans/GDP for the Irish banks stood at c.6.5X versus 2.2x for the Greek Banks."

"The L/D (Loan/Deposit) ratio of the Irish banks tested stood at 180% as of 2010, while the L/D of Greek banks stood at 122%, according to the Bank of Greece."

Not as bad as Ireland, for Greek banks.

Greek banks as of 2012, will have to maintain a minimum Tier 1 capital of 10%, as per the central bank.

Deutsche Bank adds in relation to Greek Banks:

"The government can directly inject capital into any bank it owns if it cannot privatize them first".

They estimate the capital shortfall needed so far to be in the region of 5 billion euros.

The Hellenic Financial Stability Fund, set up in October 2010 to provide capital support has 10 billion euros in capital to support its financial sector. Its duration is set until 2017. The HFSF 10 billion reserves come from the 110 billion euros rescue package provided by the EMU and IMF.

Following the 21st of July meeting for the second rescue package of 109 billion euros (which has yet to be approved by the members of the Euro zone), the firepower of the HFSF will be increased to 30 billion euros.

The worrying trend for Greek banks is not only the lack of loan growth directly tied to the poor economic situation but to some extent, a noticeable increase in the NPL ratios (Nonperforming loans). Below are three examples:

Alpha bank:

NPL ratio for FY 2009: 5.7%

NPL ratio for FY 2010: 8.5%

NPL ratio for Q1 2011: 9.3%

Deposits fell from 42 billion euros in 2009 to 37.6 billion euros in Q1 2011.

Eurobank (failed the EBA stress test on the 15th of July):

NPL ratio for FY 2009: 6.68%

NPL ratio for FY 2010: 9.60%

NPL ratio for Q1 2011: 11.40%

Deposits fell from 46 billion euros in 2009 to 40 billion euros in Q1 2011.

ATE Bank (failed the EBA stress test on the 15th of July):

NPL ratio for FY 2009: 7.6%

NPL ratio for FY 2010: 9.60%

NPL ratio for Q1 2011: 14.5%

Deposits fell from 46 billion euros in 2009 to 40 billion euros in Q1 2011.

So what is the solution to some of these increasing issues? The Greek financial system will have to go through consolidation to survive.

Remember, the name of the game is access to credit and liquidity:

"The recent significant increase in credit spreads for many financials have been driven by the markets concerned about the ability of the weaker players to access credit at reasonable rates."

Basically a game of survival of the fittest.

By consolidating its banking sector, according to the same report from Deutsche Bank, Greek banks could achieve Core Tier 1 ratios between 9% and 10%, reaching therefore the 2012 objective set by the Bank of Greece:

"Our main conclusion is that based on the synergies and value creation potential M&A would make economic sense. Moreover, the creation of bigger entities could facilitate the banking system in re-accessing debt markets, although we believe will primarily depend on the fiscal performance of the sovereign and less to the size of the banks in Greece. In a nutshell, consolidation should help the banks in becoming more efficient and could even be triggered by their need to raise capital in the future. But it may not be enough to make them operate like normal banks again for as long as the sovereign risks remain high."

Conclusion: we have zombie banks in Greece, like in Ireland, and the fate of the Greek banking system now depends on ELA IV support. It is entirely depending on the outcome for Greece as a sovereign and, given 2 years Greek notes are currently yielding close to 45%, the prospects for survival aren't great at the moment, particularly with the ongoing dissents in the European political space:

So yes, the correlation between sovereigns and financial sectors is indeed very strong.

One thing Greece must address is tax cheats who represents 30 billion euros, or 12 per cent of GDP, every year. Another American solution to European woes would be, for Greece, to tax its citizens on their worldwide income, similar to the US. It would be a very efficient way to stabilise its ailing banking system and deposit outflows given one third of its funds withdrawn have gone abroad for fear of a crackdown on tax evasion. By imposing Greek citizen on their worlwide income like US citizens,, and with the help of Luxembourg authorities, Cyprus, Switzerland and the United Kingdom, the outflow could be stemmed and vital tax receipts could rapidly help close the gap on the very acute budget deficit, but that's another story...

Stay Tuned!

Labels:

Greece,

Ireland,

NPL,

Zombie Banks

Thursday, 25 August 2011

Macro update - Iceland - The Great Debt Escape

The Great Debt Escape, and why Iceland is faring better now than Ireland.

There is life after default and Iceland is a good example.

While Ireland, as I posted previously (The Irish Black Hole), sealed its demise by accepting to bail out its banking sector, sinking its public finances and its economy in the process, Iceland did not bailout its banking sector and the results could not be more evident as indicated in this post.

First of all, Iceland CDS 5 year: Deleveraging and Derisking

From infinity and beyond....1400 bps to 261 bps on the 5 year CDS, when Portugal is at 1050 bps and Ireland at 850 bps.

As I wrote in "European issues and the Greek jinx - Macro update, a focus on Iceland and more" in June this year, Iceland is trading tighter now than most peripheral countries.

From punishing interest rates to acceptable interest rates:

The benchmark interest rate in Iceland was last reported at 4.50 percent, since the 17th of August.

"From 1998 until 2010, Iceland's average interest rate was 10.66 percent reaching an historical high of 18.00 percent in October of 2008 and a record low of 5.16 percent in February of 2003." - Source Trading Economics.

While inflation has recently picked up, hence the tightening move by the Central Bank of Iceland, the inflation rate is at 5%, as reported in August 2011:

"From 1989 until 2010, the average inflation rate in Iceland was 5.88 percent reaching an historical high of 25.20 percent in December of 1989 and a record low of -0.06 percent in November of 1994." - Source Trading Economics.

And guess what unemployment is starting to fall:

Iceland GDP growth rate:

GDP growth was 2% for the 1sqt quarter of 2011.

Compare that to the GDP growth of Ireland:

1.3% GDP growth in the 1st quarter of 2011.

But what about Government Debt to GDP between Iceland and Ireland you are going to ask.

Here is the story:

Iceland Government Debt to GDP:

"The Government Debt in Iceland was last reported at 87.8 percent of the country´s GDP. From 1980 until 2009, Iceland's average Government Debt to GDP was 41.19 percent reaching an historical high of 87.80 percent in December of 2009 and a record low of 23.00 percent in December of 1981." - Source Trading Economics.

Ireland Government Debt to GDP:

"The Government Debt in Ireland was last reported at 96.2 percent of the country´s GDP. From 1980 until 2010, Ireland's average Government Debt to GDP was 68.95 percent reaching an historical high of 109.20 percent in December of 1987 and a record low of 24.80 percent in December of 2006." - Source Trading Economics.

You can clearly see the cost of what the Irish banking bailout so far has been on Ireland's public finances compared to Iceland on the two graphs below, Government budget balances:

Iceland Government Balance:

"Iceland reported a government budget deficit equivalent to 9.10 percent of the Gross Domestic Product (GDP) in 2009." - Source Trading EconomicsThere is life after default and Iceland is a good example.

While Ireland, as I posted previously (The Irish Black Hole), sealed its demise by accepting to bail out its banking sector, sinking its public finances and its economy in the process, Iceland did not bailout its banking sector and the results could not be more evident as indicated in this post.

First of all, Iceland CDS 5 year: Deleveraging and Derisking

From infinity and beyond....1400 bps to 261 bps on the 5 year CDS, when Portugal is at 1050 bps and Ireland at 850 bps.

As I wrote in "European issues and the Greek jinx - Macro update, a focus on Iceland and more" in June this year, Iceland is trading tighter now than most peripheral countries.

From punishing interest rates to acceptable interest rates:

The benchmark interest rate in Iceland was last reported at 4.50 percent, since the 17th of August.

"From 1998 until 2010, Iceland's average interest rate was 10.66 percent reaching an historical high of 18.00 percent in October of 2008 and a record low of 5.16 percent in February of 2003." - Source Trading Economics.

While inflation has recently picked up, hence the tightening move by the Central Bank of Iceland, the inflation rate is at 5%, as reported in August 2011:

"From 1989 until 2010, the average inflation rate in Iceland was 5.88 percent reaching an historical high of 25.20 percent in December of 1989 and a record low of -0.06 percent in November of 1994." - Source Trading Economics.

And guess what unemployment is starting to fall:

Iceland GDP growth rate:

GDP growth was 2% for the 1sqt quarter of 2011.

Compare that to the GDP growth of Ireland:

1.3% GDP growth in the 1st quarter of 2011.

But what about Government Debt to GDP between Iceland and Ireland you are going to ask.

Here is the story:

Iceland Government Debt to GDP:

"The Government Debt in Iceland was last reported at 87.8 percent of the country´s GDP. From 1980 until 2009, Iceland's average Government Debt to GDP was 41.19 percent reaching an historical high of 87.80 percent in December of 2009 and a record low of 23.00 percent in December of 1981." - Source Trading Economics.

Ireland Government Debt to GDP:

"The Government Debt in Ireland was last reported at 96.2 percent of the country´s GDP. From 1980 until 2010, Ireland's average Government Debt to GDP was 68.95 percent reaching an historical high of 109.20 percent in December of 1987 and a record low of 24.80 percent in December of 2006." - Source Trading Economics.

You can clearly see the cost of what the Irish banking bailout so far has been on Ireland's public finances compared to Iceland on the two graphs below, Government budget balances:

Iceland Government Balance:

Ireland Government Budget:

As I wrote in the European Vortex in November last year:

"The problem for Ireland, has I discussed in my last post is that its financial sector is damaged beyond repair and need additional support. Currently Irish banks are heavily depending on the ECB for their funding, they are indeed truly zombie banks. The issue is that it is such a black hole for Ireland's public finances, that some external support is necessary. As for Iceland, the Irish banks where too big to fail for the country, hence an estimated budget deficit of 32% for 2010."

"Ireland faces the same issue than Iceland did in relation to its banking sector. It did not kept its banking sector under scrutiny and now the whole banking sector is taking the country with it in its downfall."

But, as we know the story by now, Iceland decided for the other option of not bailing out its banking sector and, it seems the results speaks for themselves so far. Now unemployment is at 14.3% as of July 2011 in Ireland, although, latest exports figures in June, are indeed very encouraging, Ireland could have avoided such difficult situation by not signing a blank check to its banking sector and bailing out all ill-advised senior bondholders in Irish banks in the process.

Iceland is also in a position to repay 90% of the near 1 billion GBP deposited with failed Icelandic banks by UK Local authorities.

While Iceland is back from the brink by deciding not to save its banks, Ireland is still trying to recover from that ill-fated decision of bailing out its entire banking sector.

Stay tuned!

Wednesday, 24 August 2011

Markets update - Credit - Rates - Equities - The Jackson Hole leap of faith.

The Jackson Hole leap of faith: is Ben Bernanke the new messiah?

"Markets bet on Fed miracle" is the title of the WSJ.

Looks like the recent disconnect between credit and equity is unlikely to persist and I am not the only one to think that.

In JP Morgan's daily Credit Strategy & CDS/CDX update here is what they had to say:

"Yesterday the S&P 500 was up 3.4% while CDX IG was flat and HG bond spreads actually widened by 8bp (to 218bp) which is a large negative move. The relationship between IG and HG bond spreads is in line with historical trade pattern, so both the cash as derivative markets in HG credit markets are in line with each other. Both have significantly underperformed stocks, however. The historical regression between IG and S&P is almost 4 standard deviations away the 3m and 6m trading patterns (both have a strong Rsq of 89%). Based on this trading pattern IG should be at 114bp, 8bp tighter than yesterday's 126bp close.

What is driving HG credit to underperform so significantly? One possible explanation is low summer liquidity in the bond market. IG remains quite liquid, however, and IG and JULI are in line, so the liquidity argument doesn't seem to really explain the situation. A second possible explanation for the underperformance of credit is that credit is more heavily weighted to Financials which are underperforming. CDX.IG does not include the large banks, however. A more logical explanation is that lower UST yields are contributing to bond underperformance as over the past week UST yields are 10bp lower."

And JP Morgan to add in their report on the current disconnect between the credit guys and their equity friends:

"The WSJ has a headline this morning "Markets bet on Fed miracle" to explain yesterday's strong stock market performance. No HG investors with whom we have spoken expect the Fed on Friday to offer much that would actually help the economy. Equity investors, mindful of the huge stock rally sparked by the QE2 announcement at last August's Jackson Hole conference seem unwilling to be so dismissive of the Fed's options and power. It seems the difference in recent equity and credit market performance is perhaps explained by a greater faith in Fed 'miracles' from the equity side."

Well, on Friday don't expect miracles.

As pointed out by a recent report from CreditSights (From Jackson Hole to Japan - 17th of August 2011), the last time you had three dissenting votes at any FOMC meeting was November 1992. You had Charles Plosser, President of the Philadelphia FED, an inflation hawk, Richard Fisher, President of the Dallas FED, who was opposed to QE2, and he is against QE3, and moderate Minneapolis President Narayana Kocherlakota, who is against additional accomodation. According to the same report, Ben has four options on the table:

1. Additional purchases of longer term securities;

2. Modifying the committee's communications;

3. Reducing the interest rate paid on excess reserves;

4. Increasing the FOMC's inflation goals.

Fourth option has already been dismissed. So what is left is re-investing the proceeds of the MBS holdings into longer maturity treasuries to extend the duration of the FED's portfolio.

Probably the reason why David Rosenberg is seeing much lower 10 year Treasuries yield, and I agree with this view as well.

CreditSights in their report, thinks that the FED would need to see bigger deflation threat before engaging into a new round of QE.

On the market front today the big story was the Gold sell-off.

Could it be profit taking or forced liquidation? One thing for sure the movement was fast and furious as per the attached intraday Gold chart snapped earlier:

Truth is, the recent rise of Gold was too steep to continue at that rate. A positive pullback to some extent.

In bonds and CDS here was the picture:

And two year Greek bonds making a new record:

More than 40% yield on the two year notes.

And the consequences of the Japan downgrade by Moodys to Aa3:

Japanese Financials CDS spreads widening:

![[Graph Name]](http://i4.createsend5.com/ei/y/13/584/47F/224553/images/japan.gif)

Stay Tuned!

"Markets bet on Fed miracle" is the title of the WSJ.

Looks like the recent disconnect between credit and equity is unlikely to persist and I am not the only one to think that.

In JP Morgan's daily Credit Strategy & CDS/CDX update here is what they had to say:

"Yesterday the S&P 500 was up 3.4% while CDX IG was flat and HG bond spreads actually widened by 8bp (to 218bp) which is a large negative move. The relationship between IG and HG bond spreads is in line with historical trade pattern, so both the cash as derivative markets in HG credit markets are in line with each other. Both have significantly underperformed stocks, however. The historical regression between IG and S&P is almost 4 standard deviations away the 3m and 6m trading patterns (both have a strong Rsq of 89%). Based on this trading pattern IG should be at 114bp, 8bp tighter than yesterday's 126bp close.

What is driving HG credit to underperform so significantly? One possible explanation is low summer liquidity in the bond market. IG remains quite liquid, however, and IG and JULI are in line, so the liquidity argument doesn't seem to really explain the situation. A second possible explanation for the underperformance of credit is that credit is more heavily weighted to Financials which are underperforming. CDX.IG does not include the large banks, however. A more logical explanation is that lower UST yields are contributing to bond underperformance as over the past week UST yields are 10bp lower."

And JP Morgan to add in their report on the current disconnect between the credit guys and their equity friends:

"The WSJ has a headline this morning "Markets bet on Fed miracle" to explain yesterday's strong stock market performance. No HG investors with whom we have spoken expect the Fed on Friday to offer much that would actually help the economy. Equity investors, mindful of the huge stock rally sparked by the QE2 announcement at last August's Jackson Hole conference seem unwilling to be so dismissive of the Fed's options and power. It seems the difference in recent equity and credit market performance is perhaps explained by a greater faith in Fed 'miracles' from the equity side."

Well, on Friday don't expect miracles.

As pointed out by a recent report from CreditSights (From Jackson Hole to Japan - 17th of August 2011), the last time you had three dissenting votes at any FOMC meeting was November 1992. You had Charles Plosser, President of the Philadelphia FED, an inflation hawk, Richard Fisher, President of the Dallas FED, who was opposed to QE2, and he is against QE3, and moderate Minneapolis President Narayana Kocherlakota, who is against additional accomodation. According to the same report, Ben has four options on the table:

1. Additional purchases of longer term securities;

2. Modifying the committee's communications;

3. Reducing the interest rate paid on excess reserves;

4. Increasing the FOMC's inflation goals.

Fourth option has already been dismissed. So what is left is re-investing the proceeds of the MBS holdings into longer maturity treasuries to extend the duration of the FED's portfolio.

Probably the reason why David Rosenberg is seeing much lower 10 year Treasuries yield, and I agree with this view as well.

CreditSights in their report, thinks that the FED would need to see bigger deflation threat before engaging into a new round of QE.

On the market front today the big story was the Gold sell-off.

Could it be profit taking or forced liquidation? One thing for sure the movement was fast and furious as per the attached intraday Gold chart snapped earlier:

Truth is, the recent rise of Gold was too steep to continue at that rate. A positive pullback to some extent.

In bonds and CDS here was the picture:

And two year Greek bonds making a new record:

More than 40% yield on the two year notes.

And the consequences of the Japan downgrade by Moodys to Aa3:

Japanese Financials CDS spreads widening:

![[Graph Name]](http://i4.createsend5.com/ei/y/13/584/47F/224553/images/japan.gif)

Stay Tuned!

Labels:

Ben Bernanke,

David Goldman,

David Rosenberg,

FED,

Gold,

Jackson Hole,

Japan,

QE

Macro update - Ireland June trade surplus - A glimmer of hope?

Is Ireland showing us a glimmer of hope?

In my previous post "the more it changes, the more it's the same thing" - Review of the ongoing economic issues", written in March this year, I indicated Ireland 10 year bonds broke north of 10% for the first time since 1992.

Also I indicated:

"From 1991 until 2010 Ireland's Government Bond Yield for 10 Year Notes averaged 5.72 percent reaching an historical high of 10.47 percent in December of 1992 and a record low of 3.06 percent in September of 2005."

I argued at the time:

"The example of Ireland clearly showed the issue, where Ireland's public finances were put in disarray due to the massive bail out need of its financial sector" (please see previous posts on that subject: The European Vortex, The Irish Black Hole, Ireland in the need of a lucky Shamrock).

But, we are starting to see divergence between Portugal and Ireland, not only in the CDS 5 year space, but also in the 10 year government bond space:

Ireland 5 year CDS versus Portugal 5 year CDS, correlation was one and breaking since a couple of weeks as per below grap:

Portugal 10 year bonds yield:

As per an article published in Bloomberg today by Lukanyo Mnyanda and Anchalee Worrachate:

Aug. 24 (Bloomberg) -- "Irish bonds are delivering the best

returns in the world as investors bet the former Celtic Tiger is the most likely of the euro areas bailed-out nations to grow itself out of trouble, while Portugal and Greece shrink. Irish securities handed investors a 14 percent gain in the past three months, the highest among 26 government debt markets, according to indexes compiled by Bloomberg and the European Federation of Financial Analysts Societies. The nation's 10-year yield is at more than two percentage points below its three-month average, the biggest recovery among the countries that received aid. Greek yields are 1.13 percentage points higher than their average since May 23, while those of Portugal are 2 basis points above their mean."

I indicated in my post "European Government Bonds - Back to the Future?" that:

"Ireland has in the past faced economic difficulties as well as high interest rates and recovered. Could it be really different this time? Could Ireland not recover from this crisis? What sunk Ireland so fast was its financial sector. Time will tell."

In relation to Ireland we are indeed getting very positive trades figures as indicated by Dr Constantin Gurdgiev in his excellent blog "True Economics":

"Latest trade stats are out for June 2011 for Ireland and the results are, overall, excellent:

The seasonally adjusted trade surplus increased by 7.54% mom (a whooping 22.45% yoy) to €4,079m. This is the highest monthly surplus ever recorded in nominal seasonally-adjusted terms.

Compared to June 2009, trade surplus increased 7.48% (+€283.8 million) and compared to June 2010 trade surplus is up 22.45% (+€747.9 million).

The non-seasonally adjusted trade surplus in June 2011 was €4,473m comprising exports of €8,343m and imports of €3,870m. Per CSO: "This is the highest trade surplus since June 2001".

Imports came in at a weak €3,821 million in seasonally-adjusted terms in June 2011, down 7.48% on June 2010 and up 2.83% on June 2009.

Exports posted the best seasonally-adjusted performance since February 2011, reaching €7,900 million in June 2011, up 5% (+374.6 million) mom. Exports rose 5.89% yoy (+€439.1 million) and 5.18% (+€388.90 million) on June 2009."

And Dr Gurdgiev to conclude is must read post:

"On the net, therefore, very positive set of figures on trade from Irish exporters! something truly worth cheering."

Of course it is too early to conclude Ireland is out of trouble given the current European situation and with unemployment at 14.3% in July 2011, but, in all this current gloom and doom situation, it was worth highlighting these latest figures.

In my previous post "the more it changes, the more it's the same thing" - Review of the ongoing economic issues", written in March this year, I indicated Ireland 10 year bonds broke north of 10% for the first time since 1992.

Also I indicated:

"From 1991 until 2010 Ireland's Government Bond Yield for 10 Year Notes averaged 5.72 percent reaching an historical high of 10.47 percent in December of 1992 and a record low of 3.06 percent in September of 2005."

I argued at the time:

"The example of Ireland clearly showed the issue, where Ireland's public finances were put in disarray due to the massive bail out need of its financial sector" (please see previous posts on that subject: The European Vortex, The Irish Black Hole, Ireland in the need of a lucky Shamrock).

But, we are starting to see divergence between Portugal and Ireland, not only in the CDS 5 year space, but also in the 10 year government bond space:

Ireland 5 year CDS versus Portugal 5 year CDS, correlation was one and breaking since a couple of weeks as per below grap:

Portugal 10 year bonds yield:

As per an article published in Bloomberg today by Lukanyo Mnyanda and Anchalee Worrachate:

Aug. 24 (Bloomberg) -- "Irish bonds are delivering the best

returns in the world as investors bet the former Celtic Tiger is the most likely of the euro areas bailed-out nations to grow itself out of trouble, while Portugal and Greece shrink. Irish securities handed investors a 14 percent gain in the past three months, the highest among 26 government debt markets, according to indexes compiled by Bloomberg and the European Federation of Financial Analysts Societies. The nation's 10-year yield is at more than two percentage points below its three-month average, the biggest recovery among the countries that received aid. Greek yields are 1.13 percentage points higher than their average since May 23, while those of Portugal are 2 basis points above their mean."

I indicated in my post "European Government Bonds - Back to the Future?" that:

"Ireland has in the past faced economic difficulties as well as high interest rates and recovered. Could it be really different this time? Could Ireland not recover from this crisis? What sunk Ireland so fast was its financial sector. Time will tell."

In relation to Ireland we are indeed getting very positive trades figures as indicated by Dr Constantin Gurdgiev in his excellent blog "True Economics":

"Latest trade stats are out for June 2011 for Ireland and the results are, overall, excellent:

The seasonally adjusted trade surplus increased by 7.54% mom (a whooping 22.45% yoy) to €4,079m. This is the highest monthly surplus ever recorded in nominal seasonally-adjusted terms.

Compared to June 2009, trade surplus increased 7.48% (+€283.8 million) and compared to June 2010 trade surplus is up 22.45% (+€747.9 million).

The non-seasonally adjusted trade surplus in June 2011 was €4,473m comprising exports of €8,343m and imports of €3,870m. Per CSO: "This is the highest trade surplus since June 2001".

Imports came in at a weak €3,821 million in seasonally-adjusted terms in June 2011, down 7.48% on June 2010 and up 2.83% on June 2009.

Exports posted the best seasonally-adjusted performance since February 2011, reaching €7,900 million in June 2011, up 5% (+374.6 million) mom. Exports rose 5.89% yoy (+€439.1 million) and 5.18% (+€388.90 million) on June 2009."

And Dr Gurdgiev to conclude is must read post:

"On the net, therefore, very positive set of figures on trade from Irish exporters! something truly worth cheering."

Of course it is too early to conclude Ireland is out of trouble given the current European situation and with unemployment at 14.3% in July 2011, but, in all this current gloom and doom situation, it was worth highlighting these latest figures.

Monday, 22 August 2011

Markets update - Credit Terminal Velocity?

Definition of Terminal Velocity:

"In fluid dynamics an object is moving at its terminal velocity if its speed is constant due to the restraining force exerted by the fluid through which it is moving.

A free-falling object achieves its terminal velocity when the downward force of gravity (Fg) equals the upward force of drag (Fd). This causes the net force on the object to be zero, resulting in an acceleration of zero.

As the object accelerates (usually downwards due to gravity), the drag force acting on the object increases, causing the acceleration to decrease. At a particular speed, the drag force produced will equal the object's weight (mg). At this point the object ceases to accelerate altogether and continues falling at a constant speed called terminal velocity (also called settling velocity)."

As per my previous post relating on liquidity issues (Macro and Markets update - It's the liquidity stupid...and why it matters again...), tensions are indeed escalating in the global banking system and in particular in the USD funding markets.

Large cash USD cash buffers have been built up on balance sheets of US branches by large European banks:

But, according to a recent report by Nomura (Special Topics - The Growing USD funding problem) from the 19th of August, over recent weeks, the dynamics of the funding market have changed. The USD cash buffer has been falling according to FED data from 889 billions USD on July 20 to 758 billions USD on August 3rd:

In fact, according to the same report, there was a notable decline of 131 billions USD in two weeks, clearly a trend to watch.

Nomura's analysts in the report estimate that the USD cash buffer highlighted above is down 125 to 175 billions USD from its August 3 level to 580-630 billions USD currently. Terminal velocity?

As I previously posted banks CDS, and in particular in the subordinate space have been dramatically rising recently:

Itraxx 5 year Financial Subordinate index:

Itraxx 5 year Financial Senior index:

We are definitely in the red zone as far as CDS spreads for financials are indicating. At 250 bps on the 5 year for Itraxx Financial Senior CDS, we have broken another record.

Nomura to add:

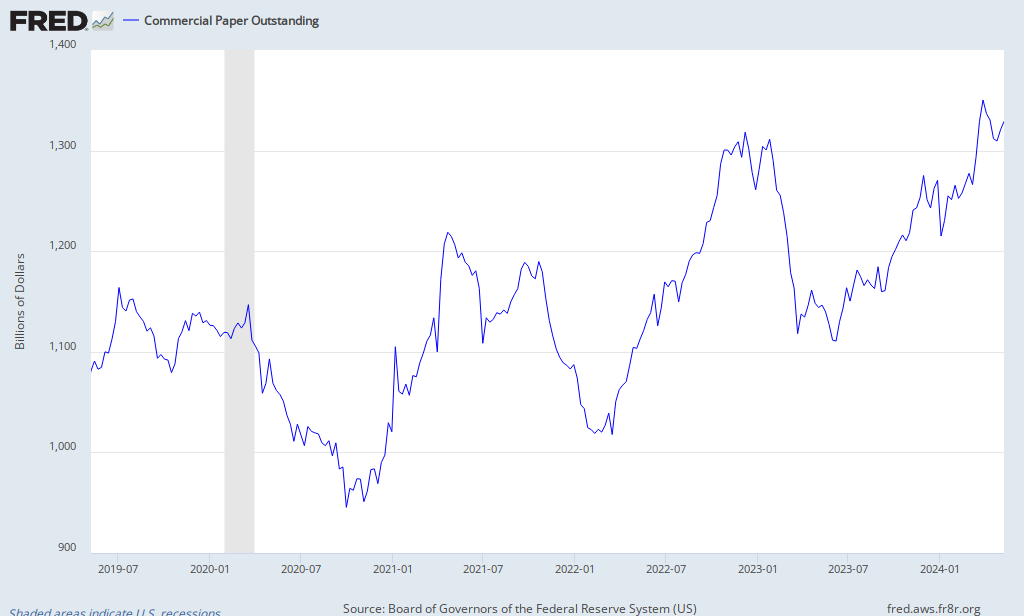

"Access to USD CP funding for international banks continue to deteriorate. Thursday's Fed data on outstanding commercial paper showed a further decline, indicating that some European banks are having difficulty rolling paper."

So far, we have a clear sign of deterioration of the outlook for future funding given current volatility in the credit markets, reducing therefore the ability for banks to raise medium to long term funding as I previously explained.

In my previous post, we saw that most of the funding needs for 2011 had been covered for major European banks.

According to the same report from Nomura the USD cash buffer remains large from a historical perspective at 580-630 bn USD. It was 50 bn USD pre-crisis (2007 and early 2008) and averaged around 400 bn USD in 2010.

The lack of political resolve in Europe in relation to the size of the EFSF and Euro Bonds and, with credit spreads and volatility remaining high, it could potentially become problematic, with markets being shut down for new issues at the moment, if the situation lasts for too long.

In relation to banks in the peripheral space, the market is definitely and utterly shut down as clearly indicated by the CDS market:

![[Graph Name]](http://i9.cmail1.com/ei/y/2A/D00/263/012502/images/portugal.gif)

So yes, as I stated in my post on liquidity, the weaker players cannot access credit at reasonable rates and it will have consequences for their economy and growth prospects. Credit crunch redux?

And that's what Societe Generale's analyst Suki Mann had to say in today's Euro Credit Wrap untitled "Messy":

"There's nearly always a way out of an economic mess that doesn't cause all involved a severe amount of pain; but this time it doesn't look too great for anyone. This decade's long debt binge-fuelled malaise just runs too deep, such that a painless solution to the crises no longer exists. The sticking plaster type response we've seen so far in Europe has failed to convince or work, with the politicians still thinking a cattle prod can control a stampede. The markets are not even waiting for an official recession to be called in the US - they've already made up their minds. Political foot-in-mouth disease, the weakening economic outlook and policy response which is inadequate are leaving risk markets living in perpetual fright. At least the corporate sector has been well prepared for this situation. Our analysis indicates that is the only positive one can hold onto. And just as well, because the funding markets in Europe have been closed for weeks After all, at these growth rates and anticipated more difficult refinancing markets for HY entities, we should be looking at greater default rates than we are at present. In the medium term we will be, but we need to stop looking at medium/longer term outlooks and focus on the immediate issues and risks. Here it's about fear as we enter uncharted waters; investors are still fortifying cash positions while witnessing minimal credit fund outflows and some are positioning for weaker growth; versus, dare we say it - again, the ultimate demise of the single currency. The former is the lesser of two evils; should the latter occur, nobody wins. Most are on the fence so far as a break-up of any sorts is concerned, as it is still deemed incomprehensible (an “it'll be ok in the end” mentality still prevails). So we toy with the idea of eurobonds (will that even work?), expect more ECB buying of peripheral paper and await the EFSF further dirtying its hands. Tomorrow probably won't be better than today."

And in relation to upcoming defaults some names are clearly coming close to that point in the mortgage insurance business:

PMI Group Inc., the mortgage insurer has posted 16 straight quarterly losses and today dropped 32% to around 20 cents.

"The Arizona Department of Insurance told PMI to halt sales of new policies and stop making interest payments on $285 million in surplus notes.

“The department may take appropriate action, including commencing conservatorship proceedings” if PMI fails to satisfy regulators’" - Source Bloomberg.

The PMI Group CDS 5 year in equivalent spread:

Goodbye PMI?

And PMI's competitor MGIC Investment under tremendous pressure as well according to its 5 year CDS level:

Radian Group also in the crosshairs:

The reason behind?

"The percentage of U.S. mortgages overdue by one month rose to the highest level in a year in the second quarter as homeowners who lost jobs were unable to make their payments. The share of home loans overdue by 30 days rose to 3.46 percent of all mortgages, from 3.35 percent in the first quarter, according to a report today from the Mortgage Bankers Association in Washington. The percentage of mortgages overdue by 60 days increased to 1.37 percent from 1.35 percent, while foreclosures dropped for the second consecutive quarter.

The gain in early delinquencies signals a slowing economy may increase foreclosures, said Jay Brinkmann, chief economist of the trade group." - Source Bloomberg, Kathleen M. Howley - 22nd of August 2011

Home builder Hovnanian is also coming under fire.

Hovnanian Entreprises, under pressure as per its 5 year CDS level:

Reason behind:

Bloomberg - Kathleen M. Howley, Aug. 22:

"Sanjay Jain called his real estate broker four days ago to cancel a deal to buy a three-bedroom home in Folsom, California, unnerved by another plunge in the most volatile equities market on record. “Seeing what’s happening on the stock market made me think that it’s not a good time to be buying a home,” Jain said. “I’m going to wait and see.”

As the U.S. economy shows signs of sputtering, instability on Wall Street is sapping the confidence of would-be property buyers, said Karl Case, co founder of the S&P/Case-Shiller home-price index. That means housing, which aided every recovery except one before the most recent recession, may deepen its five-year drag on growth."

And finally as it wasn't enough for the day, I leave you with Bloomberg Chart of the day, suggesting there is a German recession ahead:

"The CHART OF THE DAY shows that when the benchmark DAX Index’s valuation fell below 1.15 times the assets of its companies in 2002 and 2008, the German economy retracted for two quarters on each occasion. The gauge’s price-to-book ratio dropped to 1.16 on Aug. 19, the lowest since 2009." - Source Bloomberg:

Stay tuned!

Subscribe to:

Posts (Atom)