Definition of Terminal Velocity:

"In fluid dynamics an object is moving at its terminal velocity if its speed is constant due to the restraining force exerted by the fluid through which it is moving.

A free-falling object achieves its terminal velocity when the downward force of gravity (Fg) equals the upward force of drag (Fd). This causes the net force on the object to be zero, resulting in an acceleration of zero.

As the object accelerates (usually downwards due to gravity), the drag force acting on the object increases, causing the acceleration to decrease. At a particular speed, the drag force produced will equal the object's weight (mg). At this point the object ceases to accelerate altogether and continues falling at a constant speed called terminal velocity (also called settling velocity)."

As per my previous post relating on liquidity issues (Macro and Markets update - It's the liquidity stupid...and why it matters again...), tensions are indeed escalating in the global banking system and in particular in the USD funding markets.

Large cash USD cash buffers have been built up on balance sheets of US branches by large European banks:

But, according to a recent report by Nomura (Special Topics - The Growing USD funding problem) from the 19th of August, over recent weeks, the dynamics of the funding market have changed. The USD cash buffer has been falling according to FED data from 889 billions USD on July 20 to 758 billions USD on August 3rd:

In fact, according to the same report, there was a notable decline of 131 billions USD in two weeks, clearly a trend to watch.

Nomura's analysts in the report estimate that the USD cash buffer highlighted above is down 125 to 175 billions USD from its August 3 level to 580-630 billions USD currently. Terminal velocity?

As I previously posted banks CDS, and in particular in the subordinate space have been dramatically rising recently:

Itraxx 5 year Financial Subordinate index:

Itraxx 5 year Financial Senior index:

We are definitely in the red zone as far as CDS spreads for financials are indicating. At 250 bps on the 5 year for Itraxx Financial Senior CDS, we have broken another record.

Nomura to add:

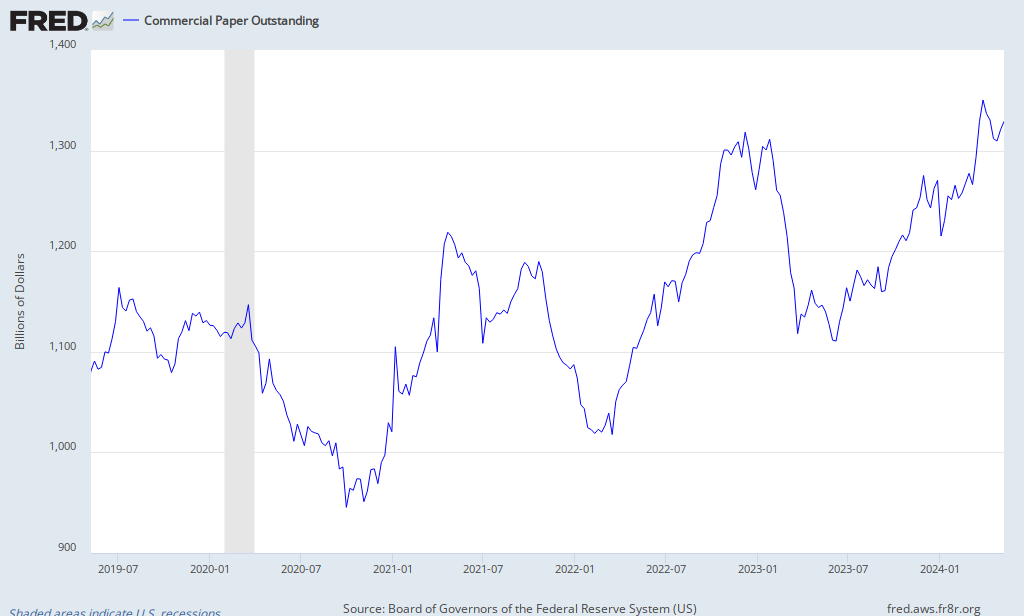

"Access to USD CP funding for international banks continue to deteriorate. Thursday's Fed data on outstanding commercial paper showed a further decline, indicating that some European banks are having difficulty rolling paper."

So far, we have a clear sign of deterioration of the outlook for future funding given current volatility in the credit markets, reducing therefore the ability for banks to raise medium to long term funding as I previously explained.

In my previous post, we saw that most of the funding needs for 2011 had been covered for major European banks.

According to the same report from Nomura the USD cash buffer remains large from a historical perspective at 580-630 bn USD. It was 50 bn USD pre-crisis (2007 and early 2008) and averaged around 400 bn USD in 2010.

The lack of political resolve in Europe in relation to the size of the EFSF and Euro Bonds and, with credit spreads and volatility remaining high, it could potentially become problematic, with markets being shut down for new issues at the moment, if the situation lasts for too long.

In relation to banks in the peripheral space, the market is definitely and utterly shut down as clearly indicated by the CDS market:

![[Graph Name]](http://i9.cmail1.com/ei/y/2A/D00/263/012502/images/portugal.gif)

So yes, as I stated in my post on liquidity, the weaker players cannot access credit at reasonable rates and it will have consequences for their economy and growth prospects. Credit crunch redux?

And that's what Societe Generale's analyst Suki Mann had to say in today's Euro Credit Wrap untitled "Messy":

"There's nearly always a way out of an economic mess that doesn't cause all involved a severe amount of pain; but this time it doesn't look too great for anyone. This decade's long debt binge-fuelled malaise just runs too deep, such that a painless solution to the crises no longer exists. The sticking plaster type response we've seen so far in Europe has failed to convince or work, with the politicians still thinking a cattle prod can control a stampede. The markets are not even waiting for an official recession to be called in the US - they've already made up their minds. Political foot-in-mouth disease, the weakening economic outlook and policy response which is inadequate are leaving risk markets living in perpetual fright. At least the corporate sector has been well prepared for this situation. Our analysis indicates that is the only positive one can hold onto. And just as well, because the funding markets in Europe have been closed for weeks After all, at these growth rates and anticipated more difficult refinancing markets for HY entities, we should be looking at greater default rates than we are at present. In the medium term we will be, but we need to stop looking at medium/longer term outlooks and focus on the immediate issues and risks. Here it's about fear as we enter uncharted waters; investors are still fortifying cash positions while witnessing minimal credit fund outflows and some are positioning for weaker growth; versus, dare we say it - again, the ultimate demise of the single currency. The former is the lesser of two evils; should the latter occur, nobody wins. Most are on the fence so far as a break-up of any sorts is concerned, as it is still deemed incomprehensible (an “it'll be ok in the end” mentality still prevails). So we toy with the idea of eurobonds (will that even work?), expect more ECB buying of peripheral paper and await the EFSF further dirtying its hands. Tomorrow probably won't be better than today."

And in relation to upcoming defaults some names are clearly coming close to that point in the mortgage insurance business:

PMI Group Inc., the mortgage insurer has posted 16 straight quarterly losses and today dropped 32% to around 20 cents.

"The Arizona Department of Insurance told PMI to halt sales of new policies and stop making interest payments on $285 million in surplus notes.

“The department may take appropriate action, including commencing conservatorship proceedings” if PMI fails to satisfy regulators’" - Source Bloomberg.

The PMI Group CDS 5 year in equivalent spread:

Goodbye PMI?

And PMI's competitor MGIC Investment under tremendous pressure as well according to its 5 year CDS level:

Radian Group also in the crosshairs:

The reason behind?

"The percentage of U.S. mortgages overdue by one month rose to the highest level in a year in the second quarter as homeowners who lost jobs were unable to make their payments. The share of home loans overdue by 30 days rose to 3.46 percent of all mortgages, from 3.35 percent in the first quarter, according to a report today from the Mortgage Bankers Association in Washington. The percentage of mortgages overdue by 60 days increased to 1.37 percent from 1.35 percent, while foreclosures dropped for the second consecutive quarter.

The gain in early delinquencies signals a slowing economy may increase foreclosures, said Jay Brinkmann, chief economist of the trade group." - Source Bloomberg, Kathleen M. Howley - 22nd of August 2011

Home builder Hovnanian is also coming under fire.

Hovnanian Entreprises, under pressure as per its 5 year CDS level:

Reason behind:

Bloomberg - Kathleen M. Howley, Aug. 22:

"Sanjay Jain called his real estate broker four days ago to cancel a deal to buy a three-bedroom home in Folsom, California, unnerved by another plunge in the most volatile equities market on record. “Seeing what’s happening on the stock market made me think that it’s not a good time to be buying a home,” Jain said. “I’m going to wait and see.”

As the U.S. economy shows signs of sputtering, instability on Wall Street is sapping the confidence of would-be property buyers, said Karl Case, co founder of the S&P/Case-Shiller home-price index. That means housing, which aided every recovery except one before the most recent recession, may deepen its five-year drag on growth."

And finally as it wasn't enough for the day, I leave you with Bloomberg Chart of the day, suggesting there is a German recession ahead:

"The CHART OF THE DAY shows that when the benchmark DAX Index’s valuation fell below 1.15 times the assets of its companies in 2002 and 2008, the German economy retracted for two quarters on each occasion. The gauge’s price-to-book ratio dropped to 1.16 on Aug. 19, the lowest since 2009." - Source Bloomberg:

Stay tuned!

No comments:

Post a Comment