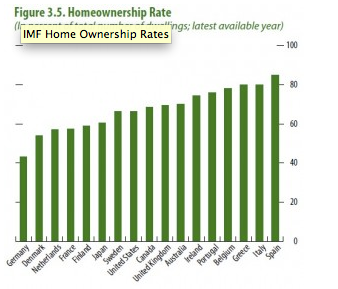

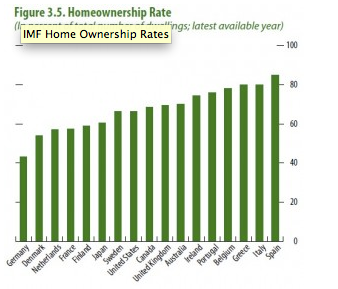

Is there a correlation with current sovereign issues with the homeownership rate? As one can see from the graph below, countries in Europe with the highest homeownership rate are currently countries facing the most pressure.

Source "naked capitalism" blog.

Ireland, Greece, Portugal, Spain and Italy, all have very high home ownership rates.

All of these are currently experiencing tremendous pressure on their sovereign spreads.

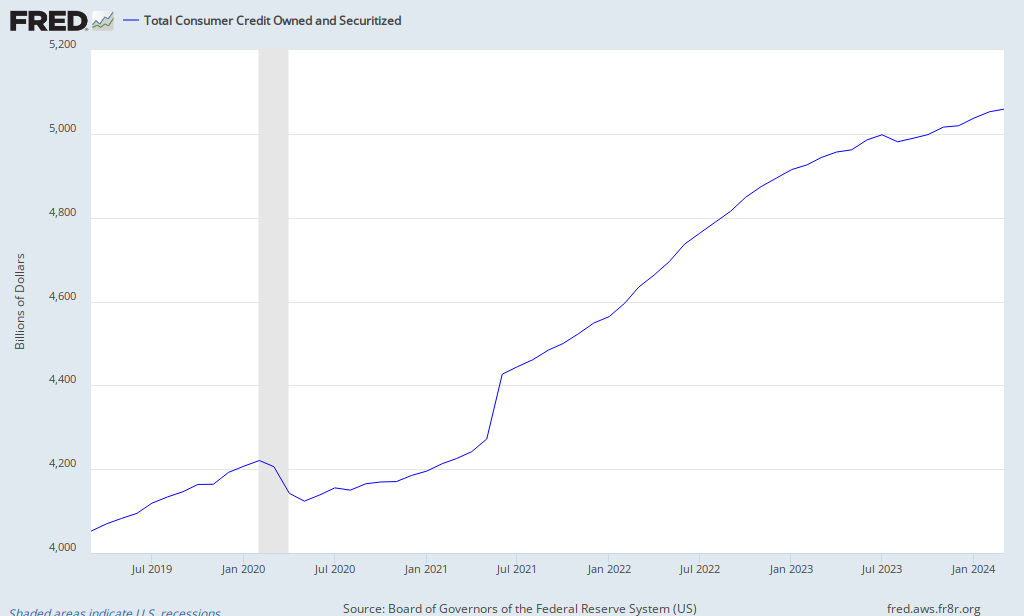

The issue with enticing a high home ownership rate is the level of household debt it generates as illustrated by the McKinsey report published in January 2010. A must read.

Household leverage measured as debt/income increased the most during the the housing credit fuelled bubble:

Most of the growth in debt was not in the financial sector during the credit bubble according to McKinsey:

The growth in lending was concentrated in residential mortgages as highlighted by McKinsey's study.

The cost of enticing home ownership in the UK is all very clear in the below graph:

Finally the sectoral composition of debt differs across economies:

In a previous post "Extend and Pretend" - Banks bloated balance sheets and the Impact of Real Estate crisis, I mentioned the following:

"Property is widely seen as a safe asset. It is arguably the most dangerous of all, says Andrew Palmer"

It can be argued that the most toxic of all bubbles is a housing/property bubble. They also always generate a financial crisis when they burst due to the leverage at play. How the risk can be mitigated? By forcing players to have more skin in the game.

Recently Sweden passed a law limitating the maximum Loan to Value (LTV) to 85%. In effect, Swedish people will need to put down a minimum of 15% of deposits to borrow 85% of the remainder.

Historically, in the US home ownership levels have been between 63% and 66% since the 1950s, only recently US home ownership has spiked to nearly 70% because of the credit bubble and its ultimate bust. What is currently happening with continuing falling prices in US house prices is a simple reverse to the mean. Everyone expects rising rents and declining apartment-vacancy rates to give housing market a welcome boost. Although buying in the US appears now more affordable, and 30 years fixed-rate mortgages have reached very low levels, given the current glut of vacant homes, where have not reached that point yet. Also, when reversing to the mean, markets often tends to overshoot. About 10% of 130 million homes in the US remain empty.

In Germany, historically, home ownership is notoriously lower. It was 43% in 2008. UK and the US were at the same level in 2008-2009, around 70%.

Germany's low home ownership rate stems from various factors, weaker population growth, very strong tenant rights, as well very heavily regulated mortgage market.

How Germany Achieved Stable and Affordable Housing - from the blog "naked capitalism".

Here is an extract of the conclusion of the article comparing the UK and German home ownership rate:

"The contrast between the German and UK housing markets couldn’t be more stark.

Unlike Germany, the UK housing market is essentially a bubble factory. Wheras Germany’s highly responsive supply ensures that extra demand manifests itself in rising new home construction rather than increased prices, the opposite is the case under the UK’s restrictive land-use policies.

The UK’s deregulated rental market and lack of tenure has also ensured that renting is a second rate option, thereby encouraging residents to strive (and borrow big) for owner occupancy. And of course the UK’s lax financial system has been only too happy to oblige, providing households with no deposit mortgages during the boom followed by rationed credit during the bust.

When all these factors are combined, is there any wonder why Germany’s home prices have remained stable and affordable, and free of the speculative behaviour, ’panic buying’ , and price volatility inherent in the UK system?

It’s a shame that Australia has inadvertently adopted the worst aspects of the UK housing market, namely: the UK-style planning system, complete with similar vertical fiscal imbalances with respect to federal, state and local taxation revenues; a deregulated rental market offering insecure tenure; and a deregulated mortgage market that provides low deposit finance at generous multiples of income."

Australia is facing the same issues relating to its housing market as the UK have been facing.

But in addition to the author of the post's conclusion, German banks opt to lend money first to its industries before housing, and it does make a very big difference in the economic growth and competitiveness between the UK economy and German economy. A lower ownership rate in Germany has been beneficial in reducing the impact of the economic recession and the speed of the bounce back as shown in the below graph relating to German GDP growth:

and the UK GDP growth during the same period:

The credit crunch has caused a massive surge in UK and US unemployment. In times of economic expansion, countries like Germany doesn't reap the benefit of a strong and booming real estate market. But a government adopting a cautious stance in relation to home ownership rate in conjunction with stronger regulation and countercyclical measures such as the ones which have been successfully implemented in Canada (see previous post relating to Canada), will have more stability in times of economic recession.

One could argue, that home ownership should not be recklessly encouraged by politicians as it does appear to be a "Weapon of Economic Destruction" (WED). If people are struggling to raise large deposits required to secure a mortage, should the government encourage them to leverage too far in the first place? The recent credit bubble burst in the US and the subprime debacle, highlights the dangerous results in the incestual relationship between politicians and banks, and the promotion of the "American Dream" at all cost.

End of the day, falling house prices, high unemployment and negative equity have a big impact on US labor mobility in particular and the US economy in general.

Source "naked capitalism" blog.

Ireland, Greece, Portugal, Spain and Italy, all have very high home ownership rates.

All of these are currently experiencing tremendous pressure on their sovereign spreads.

The issue with enticing a high home ownership rate is the level of household debt it generates as illustrated by the McKinsey report published in January 2010. A must read.

Household leverage measured as debt/income increased the most during the the housing credit fuelled bubble:

Most of the growth in debt was not in the financial sector during the credit bubble according to McKinsey:

The growth in lending was concentrated in residential mortgages as highlighted by McKinsey's study.

The cost of enticing home ownership in the UK is all very clear in the below graph:

Finally the sectoral composition of debt differs across economies:

In a previous post "Extend and Pretend" - Banks bloated balance sheets and the Impact of Real Estate crisis, I mentioned the following:

"Property is widely seen as a safe asset. It is arguably the most dangerous of all, says Andrew Palmer"

It can be argued that the most toxic of all bubbles is a housing/property bubble. They also always generate a financial crisis when they burst due to the leverage at play. How the risk can be mitigated? By forcing players to have more skin in the game.

Recently Sweden passed a law limitating the maximum Loan to Value (LTV) to 85%. In effect, Swedish people will need to put down a minimum of 15% of deposits to borrow 85% of the remainder.

Historically, in the US home ownership levels have been between 63% and 66% since the 1950s, only recently US home ownership has spiked to nearly 70% because of the credit bubble and its ultimate bust. What is currently happening with continuing falling prices in US house prices is a simple reverse to the mean. Everyone expects rising rents and declining apartment-vacancy rates to give housing market a welcome boost. Although buying in the US appears now more affordable, and 30 years fixed-rate mortgages have reached very low levels, given the current glut of vacant homes, where have not reached that point yet. Also, when reversing to the mean, markets often tends to overshoot. About 10% of 130 million homes in the US remain empty.

In Germany, historically, home ownership is notoriously lower. It was 43% in 2008. UK and the US were at the same level in 2008-2009, around 70%.

Germany's low home ownership rate stems from various factors, weaker population growth, very strong tenant rights, as well very heavily regulated mortgage market.

How Germany Achieved Stable and Affordable Housing - from the blog "naked capitalism".

Here is an extract of the conclusion of the article comparing the UK and German home ownership rate:

"The contrast between the German and UK housing markets couldn’t be more stark.

Unlike Germany, the UK housing market is essentially a bubble factory. Wheras Germany’s highly responsive supply ensures that extra demand manifests itself in rising new home construction rather than increased prices, the opposite is the case under the UK’s restrictive land-use policies.

The UK’s deregulated rental market and lack of tenure has also ensured that renting is a second rate option, thereby encouraging residents to strive (and borrow big) for owner occupancy. And of course the UK’s lax financial system has been only too happy to oblige, providing households with no deposit mortgages during the boom followed by rationed credit during the bust.

When all these factors are combined, is there any wonder why Germany’s home prices have remained stable and affordable, and free of the speculative behaviour, ’panic buying’ , and price volatility inherent in the UK system?

It’s a shame that Australia has inadvertently adopted the worst aspects of the UK housing market, namely: the UK-style planning system, complete with similar vertical fiscal imbalances with respect to federal, state and local taxation revenues; a deregulated rental market offering insecure tenure; and a deregulated mortgage market that provides low deposit finance at generous multiples of income."

Australia is facing the same issues relating to its housing market as the UK have been facing.

But in addition to the author of the post's conclusion, German banks opt to lend money first to its industries before housing, and it does make a very big difference in the economic growth and competitiveness between the UK economy and German economy. A lower ownership rate in Germany has been beneficial in reducing the impact of the economic recession and the speed of the bounce back as shown in the below graph relating to German GDP growth:

and the UK GDP growth during the same period:

The credit crunch has caused a massive surge in UK and US unemployment. In times of economic expansion, countries like Germany doesn't reap the benefit of a strong and booming real estate market. But a government adopting a cautious stance in relation to home ownership rate in conjunction with stronger regulation and countercyclical measures such as the ones which have been successfully implemented in Canada (see previous post relating to Canada), will have more stability in times of economic recession.

One could argue, that home ownership should not be recklessly encouraged by politicians as it does appear to be a "Weapon of Economic Destruction" (WED). If people are struggling to raise large deposits required to secure a mortage, should the government encourage them to leverage too far in the first place? The recent credit bubble burst in the US and the subprime debacle, highlights the dangerous results in the incestual relationship between politicians and banks, and the promotion of the "American Dream" at all cost.

End of the day, falling house prices, high unemployment and negative equity have a big impact on US labor mobility in particular and the US economy in general.

![[Graph Name]](http://i8.cmail4.com/ei/y/CE/5D9/168/221621/graph.gif)

![[Graph Name]](http://i1.cmail5.com/ei/y/25/E25/04E/214743/images/italy.gif)

![[Graph Name]](http://i5.createsend1.com/ei/y/CD/200/E9E/221505/images/italy.gif)

![[Graph Name]](http://i10.cmail2.com/ei/y/45/E14/7E0/214838/images/eusovs.gif)

![[Graph Name]](http://i7.cmail2.com/ei/y/45/E14/7E0/214838/images/eurosov.gif)

![[Graph Name]](http://i7.cmail2.com/ei/y/47/99D/128/215510/images/eurosov.gif)

![[Graph Name]](http://i6.cmail2.com/ei/y/47/99D/128/215510/images/eusovs.gif)